Medicare Advantage

A Medicare Advantage plan is a private health insurance plan that you may opt to get your benefits from instead of traditional Medicare. Originally called Part C, Advantage plans usually have an HMO or PPO network of doctors.

By joining one of these plans, you direct Medicare to pay the plan a set monthly amount for your care. In return, the plan will deliver all of your Part A & Part B services. You must continue to pay your Medicare Part B premium while enrolled in an Advantage plan.

Medicare Advantage are NOT Medigap plans. They work differently.

Medicare Advantage Coverage

With an Advantage plan, you will pay co-payments when you receive healthcare services. Each plan sets its own cost-sharing. For example, you might pay a copay for a primary care doctor visit, and perhaps a higher copay for a specialist. visit Likewise, some plans will charge you a daily hospital copay, and other plans might charge a flat amount for the whole stay.

Limitations, copayments and restrictions my apply, and each plan’s benefits, formulary, pharmacy network provider network, premium and copayments may change on January 1 of each year. Members need to be diligent about reviewing the plan materials sent to them each year in September to see what’s changing.

All Medicare Advantage plans must include an out-of-pocket maximum cap on your medical spending. The highest cap allowed by Medicare is $6,700, although some plans may be lower. Think of this as a safety net. If you have heavy health spending that results in you spending $6,700 out of pocket in a calendar year, then the plan kicks in and pays the rest for the remainder of the calendar year (Part D expenses are calculated separately.)

These plans also frequently include small extras that original Medicare doesn’t cover. Some common examples would be vision benefits, hearing discounts, and health and wellness programs, such as gym memberships. These benefits also can change from year to year.

Another popular feature of Advantage plans is that they often include a built-in Medicare Part D drug plan, which saves you from having to purchase that separately.

Joining a Medicare Advantage plan

Part C Advantage plans have different networks, premiums, and cost sharing. Working with an insurance agency that specializes in these plans is a great way to ensure that you consider all the variables before choosing your insurance company.

Types of Medicare Advantage (Part C) plans

It's important to understand the differences between the types of Medicare Advantage plans to see which works best for you. There are several different types of Medicare Advantage plans:

- HMO (Health Maintenance Organization plan): Lets you see doctors and other health professionals who participate in its provider network. If your doctor is already in network, it could be a good option because you tend to pay less out-of-pocket with in-network doctors.

- PPO (Preferred Provider Organization plan): Covers both in- and out-of-network providers, giving you the freedom to choose any doctor that accepts Medicare assignment, which can work if you prefer that kind of flexibility.

- PFFS (Private Fee-for-Service plan): The plan determines how much it will pay providers and how much you must pay when you get care. The treating doctor has to accept the plan’s payment terms and agree to treat you. If the doctor doesn’t agree to those terms, then the PFFS plan will not cover services through that doctor.

- SNP (Special Needs Plans): Are especially for people who have certain special needs. The three different SNP plans cover Medicare beneficiaries living in institutions, those who are dual-eligible for Medicaid and Medicare, and those with chronic conditions such as diabetes, End Stage Renal Disease (ESRD), or HIV/AIDS. This type of plan always includes prescription drug coverage.

- HMO-POS (Health Maintenance Organization - Point of Service plan): Covers both in- and out-of-network health services, but at different rates. You pay less out-of-pocket when you go to in-network doctors, labs, hospitals, and other health care providers.

- MSA (Medical Savings Account plan): Includes both a high deductible and a bank account to help you pay that deductible. The amount deposited into the account varies from plan to plan. The money is tax-free as long as you use it on IRS-qualified medical expenses, which include the health plan's deductible.

Medicare Supplement

A Medicare Supplement Insurance (Medigap) policy, sold by private companies, can help pay some of the health care costs that Original Medicare doesn't cover, like co-payments, coinsurance, and deductibles.

Some Medigap policies also offer coverage for services that Original Medicare doesn't cover, like medical care when you travel outside the U.S. If you have Original Medicare and you buy a Medigap policy, Medicare will pay its share of the Medicare-approved amount for covered health care costs. Then your Medigap policy pays its share.

A Medigap policy is different from a Medicare Advantage Plan. Those plans are ways to get Medicare benefits, while a Medigap policy only supplements your Original Medicare benefits.

8 things to know about Medigap policies

- You must have Medicare Part A and Part B.

- If you have a Medicare Advantage Plan, you can apply for a Medigap policy, but make sure you can leave the Medicare Advantage Plan before your Medigap policy begins.

- You pay the private insurance company a monthly premium for your Medigap policy in addition to the monthly Part B premium that you pay to Medicare.

- A Medigap policy only covers one person. If you and your spouse both want Medigap coverage, you'll each have to buy separate policies.

- You can buy a Medigap policy from any insurance company that's licensed in your state to sell one.

- Any standardized Medigap policy is guaranteed renewable even if you have health problems. This means the insurance company can't cancel your Medigap policy as long as you pay the premium.

- Some Medigap policies sold in the past cover prescription drugs, but Medigap policies sold after January 1, 2006 aren't allowed to include prescription drug coverage. If you want prescription drug coverage, you can join a Medicare Prescription Drug Plan (Part D).

- It's illegal for anyone to sell you a Medigap policy if you have a Medicare Medical Savings Account (MSA) Plan.

Medigap policies don't cover everything

Medigap policies generally don't cover long-term care, vision or dental care, hearing aids, eyeglasses, or private-duty nursing.

Insurance plans that aren't Medigap

Some types of insurance aren't Medigap plans, they include:

- Medicare Advantage Plans (like an HMO, PPO, or Private Fee-for-Service Plan)

- Medicare Prescription Drug Plans

- Medicaid

- Employer or union plans, including the Federal Employees Health Benefits Program (FEHBP)

- TRICARE

- Veterans' benefits

- Long-term care insurance policies

- Indian Health Service, Tribal, and Urban Indian Health plans

Dropping your entire Medigap policy (not just the drug coverage)

If you decide to drop your entire Medigap policy, you need to be careful about the timing. For example, you may want a completely different Medigap policy—not just your old Medigap policy without the prescription drug coverage. Or you might decide to switch to a Medicare Advantage Plan that offers prescription drug coverage.

You have to pay a late enrollment penalty when you join a new Medicare drug plan if:

- You drop your entire Medigap policy and the drug coverage wasn't creditable prescription drug coverage, or

- You go 63 days or more in a row before your new Medicare drug coverage begins

Medicare Part D

Medicare Part D insurance is healthcare coverage that helps beneficiaries pay for prescription drugs. You can obtain Part D coverage in two different ways. If you have Part A and/or Part B, you can enroll in a stand-alone prescription drug plan that works in conjunction with your original benefits. Or, if you have both Part A and Part B, you can enroll in an Advantage Plan (Part C) that includes prescription drug coverage.

According to federal law, everyone who is eligible for Part A and/or Part B is also eligible for a prescription drug plan. These are the two ways you can get coverage:

- Prescription Drug Plan (PDP): This is a separate, stand-alone insurance you can buy in addition to Part A and B or a Supplement (MediGap) insurance plan.

- Advantage Plans: You can combine Part A, Part B, and Part D coverage into one comprehensive plan. Many Advantage Plans include Part D, but some do not.

Medicare Part D

Medicare Part D is a prescription drug coverage plan sold by private health insurance companies. It can be a standalone addition to Original Medicare, or it can be included in a Medicare Advantage plan. You will have to pay a monthly premium to have a Part D policy, and the plan will require you to pay other out-of-pocket costs like deductibles, copays, and coinsurance. A Medicare Savings program or “Extra Help” can lower those costs if you meet eligibility requirements

A Medicare prescription drug plan is a smart way to manage the cost of the medications you take now—and those you may need in the future. If you’re entitled to Part A and/or enrolled in Part B of Original Medicare, you’re eligible to join a Part D plan; however, when you enroll affects your effective date and premium. Our team of healthcare professionals can help you understand your eligibility and explain to you the Medicare Part D plans that are available.

Affordable Prescription Drug Coverage for Seniors

Prescription drug coverage for senior’s changes at 65. Why? Because at 65, seniors are finally eligible for Medicare. It’s something they’ve paid into for decades while working. However, prescription drug coverage is not part of Original Medicare. Getting the prescription drug coverage, you enjoyed while working will take a little more arranging.

Part D Plans in 2017

Every year, Medicare Part D (Prescription Drug Coverage) undergoes changes that are important to track. These changes may directly affect your current plan. In 2017, you may see a higher deductible and initial coverage limits if you have a Standard Benefit Plan, along with other changes we will expand on below.

Cost Changes in 2017

If you compare the 2017 Standard Benefit Plan to the 2016 version, you will see changes across the board. Here are a few highlights of the Standard Benefit changes in 2017.

- $40 increase in deductible: $360 in 2016 to $400 in 2017.

- $390 increase in initial coverage limit: $3,310 in 2016 to $3,700 in 2017.

- $100 increase in out-of-pocket threshold: $4,850 to $4,950

- Increase in minimum copayment in catastrophic coverage portion of the benefit.

Deductible: $400

Each year, Medicare establishes a maximum deductible amount. For 2017, that amount is $400. Your deductible is the amount you’re responsible to pay each year for your prescription drugs before you enter the initial coverage period and Part D begins helping you pay for drugs.

Initial Coverage Limit: $3,700

Once your total yearly drug costs total the Initial Coverage Limit (ICL) of $3,700, you leave the initial coverage period and enter the Donut Hole, or Coverage Gap. Total yearly drug costs include the costs for covered medication paid by you and your prescription drug plan.

Coverage Gap (Donut Hole) Costs

40% of costs for covered brand-name drugs and 51% of costs for covered generic drugs

This is the percentage you pay for covered prescription drugs after you reach the initial coverage limit amount of $3,700 and are in the Donut Hole, or Coverage Gap. When you are in the Coverage Gap, there is a temporary change in what you will pay for drugs. During the Coverage Gap, you pay 40% of the plan’s costs for covered brand name drugs and 51% for covered generic drugs. Most drug plans have a coverage gap.

Each year, the amount beneficiaries pay while in the donut hole will reduce by a small percentage until 2020, when the coverage gap is planned to be eliminated. In 2020, you will only be responsible for 25% of brand and generic drug costs. This is part of a new law enacted to eliminate the donut hole by 2020.

Out-of-Pocket Threshold: $4,950

Once you’re spending on prescription drugs (including manufacturer discounts) reaches this amount, you are out of the Donut Hole and reach Catastrophic Level Coverage. During this phase, you will pay the greater of 5% or $3.30 for covered generic drugs. You’ll also pay the greater of 5% or $8.25 for all other covered drugs until the end of the calendar year.

Minimum Copayment in Catastrophic Coverage Portion of the Benefit

The greater of 5% of the cost or $3.30 for covered generic or preferred multi-source drugs, and the greater of 5% of the cost or $8.25 for all other covered drugs until the end of the calendar year.

This helps ensure that you only pay a small amount for drugs covered by Part D for the rest of the year while you are in catastrophic level coverage.

How to Switch Plans Each Year

If you’re not happy with the changes made to your Medicare Part D plan this year, you can switch prescription drug plans. In most cases, the only time you can switch your Part D plan is during Open Enrollment, from October 15 to December 7. Your new plan will become effective January 1th of the following year.

If you have prescription drug coverage through an Advantage Plan, you may also be able to switch from an Advantage Plan to Original Medicare during the Medicare Advantage Disenrollment Period (MADP). This period occurs from January 1 to February 14 every year. You can join a prescription drug plan when you switch to Part A and Part B during the MADP. If you make changes during the MADP, they will become effective the first day of the next month.

There are additional times that you may be able to change prescription drug plans, called Special Enrollment Periods (SEPs).

Extra Help with Medicare Prescription Drug Plan Costs

What help can I receive?

Medicare beneficiaries can qualify for Extra Help with their Medicare prescription drug plan costs. The Extra Help is estimated to be worth about $4,000 per year. To qualify for the Extra Help, a person must be receiving Medicare, have limited resources and income, and reside in one of the 50 States or the District of Columbia. Visit our information page on Extra Help qualifications.

You can find out if you qualify to make changes during a SEP by asking one of our License and Certified Insurance Adviser’s.

Extra Help

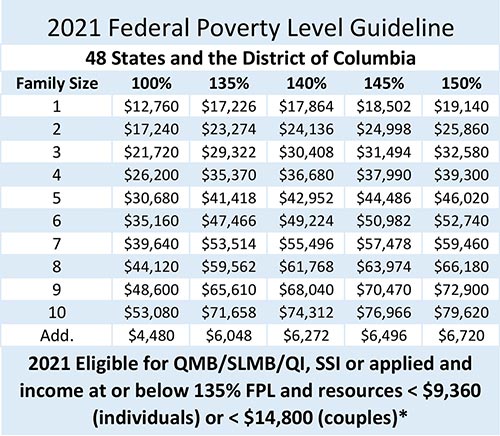

Even if you don’t qualify for full-LIS benefits, you could be eligible for partial-LIS benefits if your income level is at or below 150% FPL (resource limits also apply - see charts below).

Remember, the LIS subsidy or Extra Help may help pay your monthly Medicare Part D plan premiums and a portion of your formulary drug costs.

2021 Federal Poverty Level (FPL) Tables

Hospital Indemnity

Hospital indemnity insurance is coverage you can add to your existing health insurance plan. This form of supplemental insurance pays you a predetermined benefit amount per day for each hospital confinement. They usually pay you this daily benefit amount for up to a year.

What Does It Cover?

The coverage your hospital indemnity insurance provides will depend on your plan choice. In general, most plans cover:

- Hospital confinement (with or without surgery)

- Intensive Care Unit (ICU) confinement

- Critical Care Unit (CCU) confinement

- However, there are plans that cover even more. Some hospital indemnity coverage also includes :

- Outpatient surgery

- Continuous care

- Outpatient X-rays and laboratory procedures

- Outpatient diagnostic imaging procedures

- Ambulances

- Emergency rooms

- Physician office visits

How Much Does Hospital Indemnity Coverage Cost?

The monthly cost of a hospital indemnity plan will depend on your plan choice, age, gender, and possibly your tobacco use. For example, plans that offer fewer benefits may range from $5 to $41 per month. Plans that offer a wider range of benefits can vary anywhere from $27 all the way up to $427 per month.

Contact a licensed agent for exact benefits and coverage costs available in your area.

How Much Can the Average Hospital Stay Cost You?

With a comprehensive health insurance plan, you are still responsible for co-pays and coinsurance. On top of that, you are still required to pay your annual deductible before your plan will start covering the cost of your care. Can you predict how much you’ll owe without hospital indemnity insurance?

A 4-year study conducted by the University of Michigan revealed that a stay in the hospital could cost you over $1,200 in out-of-pocket costs (with an employer-based health insurance plan). If you have an individual health insurance plan, you could face $1,800 in out-of-pocket costs. During this study, deductibles increased 86% and coinsurance increased 33%. If out-of-pocket costs continue to rise, you will be responsible for even more money despite your health insurance coverage.

Are There Waiting Periods for Benefits?

Waiting periods vary for hospital indemnity insurance. In general, there is a 30-day waiting period before your benefits can be used toward an illness that results in hospital confinement. However, there may not be a waiting period for accidental injuries that land you in the hospital. Make sure to ask your agent about waiting periods before purchasing a hospital indemnity insurance policy.

How Does It Pay Out Benefits?

Like most supplemental insurance plans, hospital indemnity insurance pays cash benefits. This means the benefit amount you have chosen is sent directly to you instead of to your doctor or hospital.

Can You Add Dependents to a Hospital Indemnity Plan?

In some cases, yes. It is possible to add dependent children to some hospital indemnity plans. However, there will be an additional monthly premium per dependent.

Medicare for Veterans

There have been numerous questions asked on how Veterans can use a Medicare Advantage (MA), Medicare Advantage with Part D (MAPD) or Part D plans and how it coordinates with VA benefits. Keep in mind that MAPD or MA plans are NOT limited only to those with VA benefits.

Some beneficiaries may be receiving prescription coverage through their work (not a standalone Part D plan) and want an MA-only plan. Also, keep in mind that a member cannot have both the MAPD plan and a standalone Part D plan. If they enroll in the MAPD plan while already enrolled in a Part D plan or another MAPD plan, they will lose their previous coverage.

How to Coordinate Benefits

The VA prospect has a choice to either enroll in the MAPD plan or using their VA benefits for care. Their VA benefits will not be conflicted, and they may choose the MAPD plan to have the choice of how and where they obtain their prescriptions.

If a veteran would like to take advantage of the MAPD plan for second options with specialist, they must get a referral from the primary physician under the plan.

They can receive all the extra benefits under the plan, not included with their VA benefits: includes Dental, Vision, Hearing, Transportation and more.

Each plan offers different benefits, which is why it’s best to work with an Insurance Adviser who could guide you on the best plan for your unique needs.

Most plans have a free fitness facility membership and offer different services.

VA members have a “back up” or safety net for his Medicare benefits by enrolling into a MAPD plan.

VA members have choices when traveling, so they can go to any hospital in an emergency room and not try to locate a VA hospital.

VA members in the MAPD plan cannot have a prescription filled by a VA Pharmacy or take a prescription from a private doctor to the VA pharmacy to be filled.

If you have further questions contact one of our license and Certified Insurance Adviser.

Life Insurance

If you were to die prematurely, you can make sure your family is taken care of and their needs are met. There are different options, to ensure your specific wants and needs are met. Read below your options when it comes to life insurance.

Term life insurance

Term life insurance is a standard insurance policy that provides coverage for a specific period of time. This means if you don’t die within the term, your beneficiary doesn’t get the death benefit and the policy expires. You can select a term that works best for you and common lengths for term life insurance are 10, 20, or 30 years. One of the challenges for people who purchase term life insurance is deciding how long the policy should last. You may want to have the policy last until you retire or as long as your youngest dependent will need financial support.

Permanent life insurance

Permanent life insurance, as the name implies, provides coverage for your entire life, as long as you continue to pay your premiums. The premium for permanent life insurance is generally more expensive than for term life, but it usually doesn’t increase as you age. Permanent life insurance is also called cash-value insurance and is often considered a financial investment, because part of the premiums you pay are invested by the company that sold you the policy. These investments give you a tax-sheltered way to earn money.

Permanent life insurance policies have a face value and a cash value. The face value is the amount your beneficiaries receive when you die; in other words, the death benefit. The cash value is equal to the amount of premiums you have paid, plus any investment earnings. Some permanent life insurance policies guarantee growth for the cash value. Others involve more risk, which means the cash value of your policy could potentially decrease over time.

One advantage of permanent life insurance is that you don’t pay any interest on your investment earnings, and your beneficiaries don’t pay any tax on the death benefit when it is eventually paid out. In some circumstances, you can even borrow money tax free from your permanent life policy.

There are four types of permanent life insurance:

- Whole life

- Universal life

- Variable life

- Variable universal

Term vs. Whole Life Insurance

Once you decide to buy life insurance, you will be faced with a number of choices about the type of policy you should get. A life insurance comparison may be useful, especially if you’re considering term vs. whole life insurance. Here’s a look at the similarities and differences between these two popular types of life insurance.

Understanding Term and Whole life insurance

Term life insurance and whole life insurance are two of the most common types of life insurance policies, so it’s important for you to come to a clear understanding of both.

Term life insurance provides coverage for a specific amount of time. Generally, you can select the term that works best for you, and common terms include 5, 10, 15, and 20 years. There are two main types of term life insurance: annual renewable, which starts with a low premium that then increases with age, and level premium, which has a higher but fixed premium.

Whole life insurance is a type of permanent life insurance, and like all permanent life insurance plans, it’s designed to last a lifetime. Whole life insurance policies offer a fixed premium and a guaranteed increase in cash value through investments.

Pros and Cons of Term life insurance

If you’re looking for protection at a more affordable price, then term life insurance may be the right choice for you. Term life insurance is the least expensive type of life insurance, and so it’s particularly well-suited for young people who are looking for a policy with low monthly premiums. Term life insurance is affordable because you’re only paying for the lump sum cash benefit that your designated heir receives when you pass away–you’re not paying the insurance company to invest and grow your money, and you’re not earning any interest on your cash, as you would under a whole life insurance policy.

The downside of term life insurance is that your beneficiary gets nothing if you don’t pass away during the term of the policy. In addition, if your policy expires and you decide to renew, you may have to pay a higher premium if your health has deteriorated.

The biggest advantages of whole life insurance are that you can be covered for your entire life (if you keep the policy long enough) and that your minimum cash value is guaranteed. The guarantee means that part of your cash investment is safe, and that your policy keeps value in case of a market crash. In addition, your value will increase every year, and you will most probably also receive annual dividends that are exempt from taxes. Also, your monthly premium can be fixed.

Another big advantage is that you can borrow against your whole life insurance policy if you suddenly find yourself in a cash crunch or need money for any personal reason.

A whole life insurance policy is particularly well-suited to those looking for stability and wanting secure guarantees for long-term responsibilities, like funeral expenses and a steady income for the surviving spouse.

The main downside of a whole life insurance policy is its higher monthly premium. In fact, according to TheSimpleDollar.com, the cost for whole life insurance can be six to eight times higher than that of term life insurance.

Life Insurance for Every Life Stage

As you go through life, your needs for life insurance will change as your circumstances change. If you buy life insurance when you’re single, you may decide to switch to another plan once you get married or once you become a parent. In order to choose life insurance that best fits your needs at a specific point in time, it’s important to understand the various life stages that you may experience, learn about adequate plans for each life stage, and get life insurance quotes for your selected plans.

When You’re Young and Single

Even though you may think that life insurance is not necessary when you’re young and single, that’s often not the case. You may have debt you don’t want to pass on to any living relatives who might be responsible for the debt in case of an early death or you may wish to leave a legacy—a donation to a cause that stokes your passion. If you buy a permanent life insurance policy when you’re young, you could enjoy lower premiums, benefit from the insurance policy’s cash value, and create a financial safety net that will last your entire lifetime.

The Family Life

If you’re a newlywed, you may be embarking on exciting adventures, like purchasing your first home, possibly changing jobs, and starting a family. However, you will need to be prepared should something happen and one of you is left alone. This is where life insurance comes in. It can help ease the financial burden brought on by the untimely and sudden death of a spouse. For example, you may want to buy term mortgage life insurance to cover your home mortgage payments, so that your spouse and children can have a roof over their heads should something happen to you.

Once you have children, you will also want to provide them with financial protection should something happen to you or your spouse. A family life insurance policy (term or permanent) that pays a lump sum or a regular income after your death can ensure that your children are financially protected.

Business and Work

If you own a business, you may want to buy life insurance to protect the company you’ve built. If you were to pass away, what would happen to your company? With life insurance, you can fund a buy-sell agreement that would ensure that the remaining partners are in a position to buy your ownership stake in case of your demise. A good option in this case may be term life insurance for perhaps 20 years, where the cost of the insurance would be lower than permanent life insurance and still provide protection for your heirs and business partners.

A stay-at-home parent can also buy life insurance to ensure his or her loved ones are protected should something happen to them. The services a stay-at-home parent provides are costly, and hiring someone to fill that role will be become a financial burden if you’re not prepared for such an eventuality. A term life insurance policy that covers the years during which the stay-at-home parent will be taking care of the children is a good choice in this specific case.

Planning for your later years

Most retirees want to enjoy life after they stop working, and to do that you will need to have a secure nest egg. In addition, even though your children may be grown up and financially self-sufficient, it may still be a good idea to buy Final Expense life insurance. If one spouse passes away, even at an advanced age, the remaining spouse may still live 10 or 20 years and will need to have some sort of financial security. In this case, it may be a good idea to add an annuity to your life insurance policy. An annuity could ensure that you continue to receive a stream of income once you no longer receive paychecks from work, allowing you to enjoy your retirement years and offering protection should one spouse pass away.

Also, be aware that even though your children are now adults and financially independent, you may have aging parents who depend on you for financial assistance. It’s always a good idea to plan ahead, in case something happens to you, and your parents are suddenly left without a financial safety net. A permanent life insurance policy with a cash value can help care for your parents in case of your untimely death.

Find Affordable Life Insurance for Senior Citizens

While it may be less expensive to purchase a policy at a younger age, buying life insurance for senior citizens is still important. After all, the purpose of life insurance is to help protect your loved ones in the event of your passing, which often becomes more of a concern as you age. This is especially true for seniors still caring for dependents or with liquid assets.

Life insurance is an agreement you make with an insurance provider. In this agreement, you pay monthly premiums in exchange for a benefit amount that will be paid to your named beneficiaries if and when you pass away during the term of the policy. Depending on the type of policy you purchase, the benefit amount could help cover funeral and burial expenses or beneficiaries’ finances.

Do You Need Life Insurance?

Before you buy a life insurance policy, it’s important to know whether you’ll benefit from having one or not. There are certain situations where it would be advisable to purchase a policy, such as:

- People who are making their highest earnings and saving for retirement.

- Retirees who may lose a significant amount of income when a spouse dies.

- Parents with dependent children.

- Families with large, liquid estates that may be subject to an estate tax (e.g. antiques, cars, houses).

- Owners, partners, and employees of a small business.

No matter your age, if one of these situations is applicable to your current lifestyle, it is highly advisable to purchase a life insurance policy.

Four General Types of Life Insurance

In general, there are four types of life insurance policies that people buy: whole life, universal life, variable life, and term life.

- Whole life insurance provides coverage from the moment you purchase the policy until you cancel your policy or pass away. Premiums for whole life are typically fixed, and the policy maintains a cash value, which can help guarantee financial security for your loved ones.

- Universal life insurance is the most flexible permanent life policy. Increase your death benefit by passing a medical examination and have your cash value earn a money market rate of interest. After money has accumulated, you have the option to alter your premium payments if there’s enough money in your account to cover the costs.

- Variable life insurance policy combines death protection with a savings account and allows you to invest in stocks, bonds, and mutual funds. The risk associated with this policy is if your investments don’t perform well, your cash value and benefit may decrease — though some policies guarantee that your death benefit won’t fall below a minimum level.

- Term life insurance is bought to cover a certain amount of time, usually ranging from 5-30 years. Premiums are typically lower than whole life, but your policy term won’t hold cash value if unused by the end of your policy term. Some term life policies hold the same death benefit amount if the insured dies during the term, while others decrease. Term life policies can also be convertible, allowing the insurer to change from a term life policy to a whole life policy.

Find the Right Life Insurance Policy for Senior Citizens

So, which life insurance policy is best for senior citizens? You may consider taking a term life insurance policy that can be converted into a permanent policy. Term life insurance is typically more affordable, and the lower amount you pay in premiums can still help maintain your loved ones’ financial security.

No matter which policy option you choose, life insurance for senior citizens doesn’t have to be a challenge.

What is final expense life insurance?

Sometimes referred to as “funeral insurance,” final expense life insurance is meant to cover the costs associated with funerals and burials. The costs of final expenses are ones that many seniors do not account for and without insurance can easily exceed $10,000. While the cost of a final expense life insurance policy is generally nominal, the payouts are generally between $5,000-$25,000.

How does it work?

Final expense life insurance requires the policyholder to name a trustworthy beneficiary who will receive the proceeds of the benefit. Like other types of life insurance, final expense policies are available as both term and permanent options. A term policy will cover you for a certain number of years whereas a permanent policy remains in effect as long as the premiums are paid. Permanent policies have the added benefit of including a cash value component, meaning cash is able to accumulate over time on a tax-deferred basis.

How do I qualify?

Final expense life insurance is often easier to qualify for than traditional insurance and policies are underwritten either as guaranteed or simplified issue. Guaranteed issue means that anyone can qualify and no medical questions are asked during the application process. While this type of policy generally comes with a higher premium, it is a good option for those who would not otherwise qualify for life insurance coverage due to health issues. Simplified issue policies do require some medical history during the application but a medical exam is not necessary.

Why You Need Protection for Final Expenses

DID YOU KNOW…?

- Social Security pays a one-time payment of $255 to the surviving spouse if he or she was living with the deceased. *

- Your household Social Security Income can be cut by as much as 50% with the death of a spouse.

- Ten years ago, the average adult funeral cost was $3,000. Today, the average funeral costs between $6,000 and $15,000.

- By the year 2020, funerals will average over $12,000 to $18,000 due to inflation.

Retirement Planning

Many retirees face tough decisions when it comes to their finances and how to ensure their money last them for the rest of their lives. They face new challenges from the growing cost of Healthcare and Prescription Drugs, to having adequate life insurance. Other factors are deciding whether to keep their home or down size, because they don’t have enough monthly income.

Retirement is when you leave the workforce, but it doesn’t mean becoming inactive or that you necessarily stop working. You might retire from one job and start another. Retirees have a wealth of experience and those in good health often find ways to share this knowledge, even as volunteers, helping others start a business or supporting a local charity or public service agency. They have time and opportunity without the responsibility of a regular job. The trouble with retiring is most retirees didn’t create a solid financial plan while they were working.

Some Stats

- In 2017, an estimated 171 million workers are paying into Social Security, while 51% of the workforce are not contributing into any type of private pension coverage. Workers report that 31% have no savings set aside specifically for retirement.

- Social Security has become the major source of income for most of the elderly. In 2017 about 43% of the senior population in the United States, rely strictly on Social Security for 90% or more of their income. Here are some key factors regarding the senior population:

- In 1940, the life expectancy of a 65-year-old was almost 14 years, today it is about 20 years, so most of our seniors are living longer.

- By 2035, the number of Americans 65 and older will increase from approximately 48 million today to over 80 million.

- There are currently 2.8 million workers for each Social Security beneficiary. By the year 2035, there will be only 2.2 million covered workers for each new Social Security beneficiary. This is because of the number of Baby Boomers retiring during this period.

New Benefits & Financial Services (NBFS) uses a consultative approach. We believe in educating our client’s verses selling. Educating and listening to their needs helps us create the best strategies in achieving their goals.

Building a solid financial plan for retirement is like building a house. The foundation needs to be strong to support your overall needs and last you a lifetime. Whether you’re just starting out or revisiting your finances after a family or lifestyle change, there are four key steps that can lay the cornerstones of a solid financial plan.

The 4 Key Steps

A solid financial plan needs to be structured into four key saving strategies; Emergency, Retirement, Opportunity and Investment. If these strategies are properly structured, you could create a roof of protection from Taxation and Inflation, which will bring you financial success.

- Emergency Fund: In the event of a financial setback, illness or unexpected expense, you’ll want an emergency fund that can cover three to six months of expenses—in a savings account or other safe account that’s easily accessed within three to five days without penalty. This fund should be liquid and immediately available (e.g. money in the bank).

- Retirement Funding: Most workers believe contributing to a 401(k) or other retirement plan is the proper way to prepare for retirement. Your retirement fund should consist of funding that grows Tax Deferred or free from taxation. These funds should be setup into some type of guaranteed vehicle that is guarded from Market Volatility. You will receive growth potential during accumulation with no risk to your principal.

- Investment Funding: Once you have the Emergency and Retirement funding in place, you’ll be ready to save and invest for other goals, including short- and mid-term needs, college funding for your children and additional money for retirement. Normally this would be your investment into employee benefits or company matching plans, like 401(k) or 403(b). An employer matching plan allows the employee to take advantage of extra money being contributed by their employer. In most cases, dollar for dollar up to a certain percentage. If you don’t have access to a plan at work, setup your own IRA retirement plan.

- Opportunity Income: Once you’ve setup your main three funding vehicles, some people consider starting an opportunity vehicle on the side, which allows them to take higher risk for potentially higher rewards. These funds are being invested into a business or rental properties, but could occur losses of principal. This is the higher risk reward for retirement.

Life and Health Insurance are the cornerstone of a strong financial plan. Life insurance protects your survivors in the event you die prematurely. In addition to the death benefit, permanent life insurance policies accumulate cash value. That’s money you could access for emergencies. If you no longer need the full death benefit, you could also use the cash value to supplement your retirement. Health insurance provides protection from sickness or accidents, while you are building a solid retirement plan. The rising and high cost of healthcare could wipeout your funds without adequate or no coverage at all. Recent studies show that 60 percent of people go bankrupt, or accumulate bad credit, because of high medical bills.

NBFS offers a broad and personalized service, because of our relationships with many major providers. Our proven track record has earned us positions with hundreds of various financial institutions, allowing us to offer the best strategies on the market.

We gather preliminary information for a confidential profile. Then analyze your data and prepare a blueprint suited to your individual needs. Finally, we present the results to you so you may make an educated choice.

Our goal is to work with you to prepare a blueprint for your financial success.